Buried in Governor LePage’s tax reform proposal is a good provision that would create new refundable income tax credit for low-income Maine residents. This credit is meant to offset some of the impact of sales tax increases and expansions the governor is proposing as part of his tax reform plan. The governor has correctly recognized that increasing sales taxes would have a disproportionately large impact on low-income residents. The idea for a refundable “sales tax fairness credit” comes from the “Gang of 11” tax reform proposal offered in 2013 by Senator Dick Woodbury. To be clear, it would be tied to sales taxes in name only. Taxpayers would not have to document purchases to get the credit. They would only have to file their income tax return and if their income is low enough they would qualify for the credit. Since it’s refundable, families would get the full value of the credit (as determined by the formula described below) regardless of how much tax they owe.

Maine revenue services estimates the total value of the credit would be between $60 and $70 million per year. For context, that’s just under 2 percent of the $3.4 billion State General Fund budget in 2016. The sales tax credit would account for about 10% of the total value of the individual income tax cut that LePage is proposing.

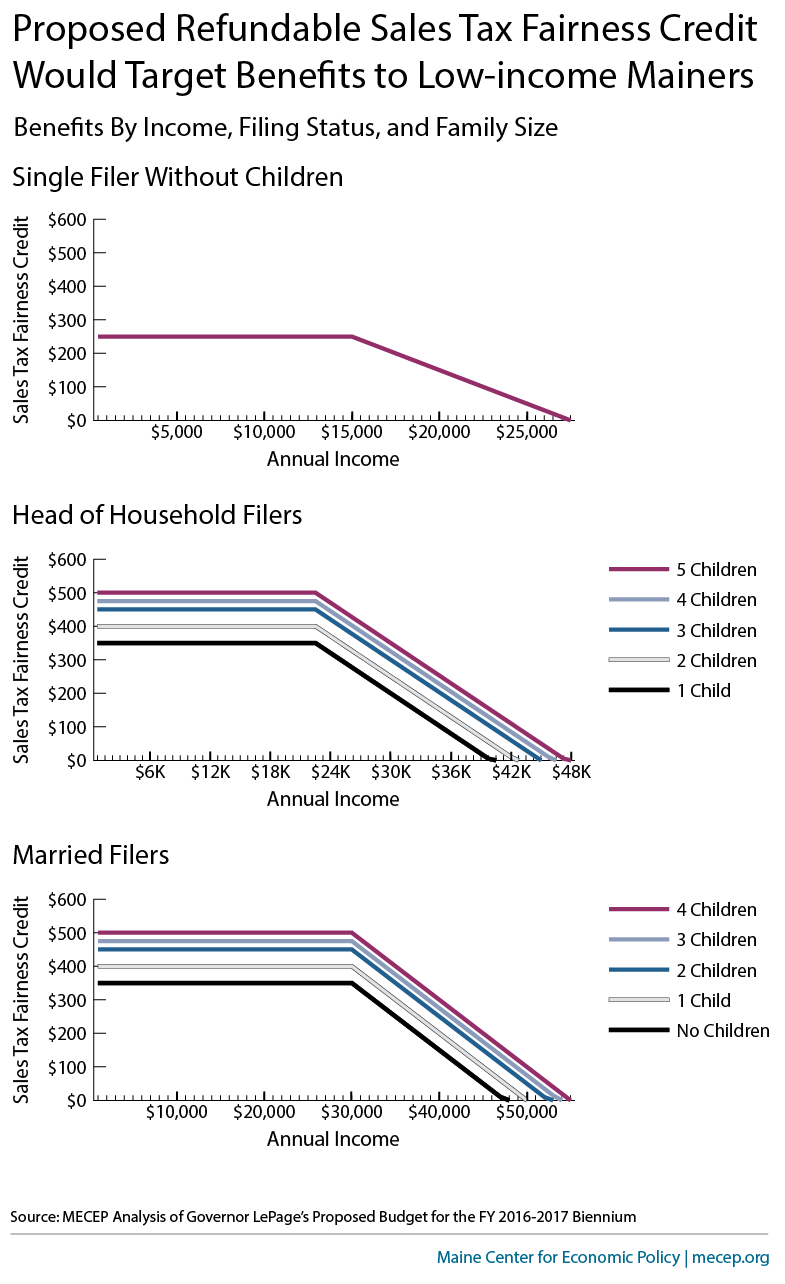

The amount of the credit depends on family income and family size. The maximum credit is as follows:

| Exemptions (Number of People in Family) | Maximum Credit |

| 1 | $250 |

| 2 | $350 |

| 3 | $400 |

| 4 | $450 |

| 5 | $475 |

| 6 | $500 |

The credit begins to phase out at $15,500 for single filers, $22,500 for Head-of-Household filers, and $30,000 for Married-Filing-Jointly filers. The following charts show the size of the credit families would receive depending on their income, filing status, and number of people in their family: