Congress has the opportunity this fall to prevent key federal working family tax credits from expiring, resulting in cuts for 50 million working Americans, 16 million of whom will slip into poverty. In Maine, these cuts to the federal earned income tax credit (EITC) and child tax credit (CTC) will affect 37,000 working families, including 64,000 children. More than 34,000 working Mainers, including 16,000 children will fall into or further into poverty.

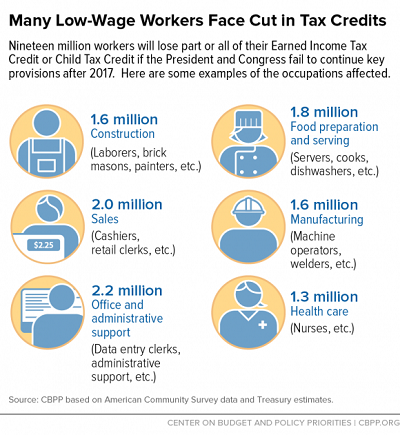

Nationally, the workers affected come from a wide variety of occupations.

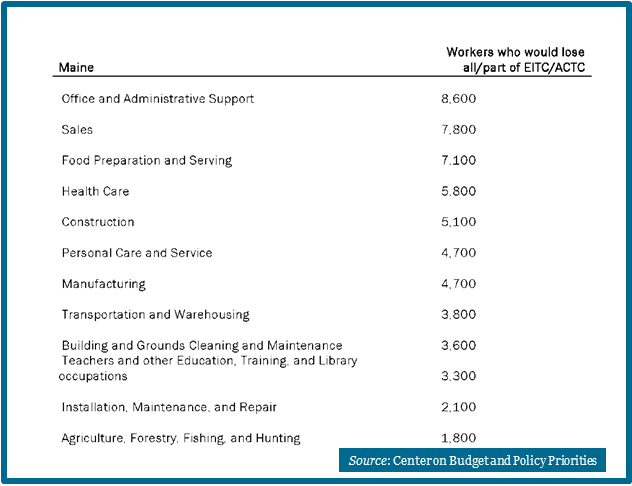

In Maine, the cuts will affect more than 60,000 employees who work in our offices, prepare and serve our meals, care for our health, and work hard at many other occupations but whose low wages make it hard to afford basic necessities, much less to save for their or their kids’ education, to buy or repair a vehicle to get them to work, or to set aside something for retirement.

As MECEP’s Garrett Martin and Eloise Vitelli of New Venture Maine wrote in a recent Bangor Daily News op ed:

“All these working family tax credits . . . boost the incomes of low-income working families, helping them make ends meet, pay for the basics, such as transportation and child care, that help them keep working and provide them an opportunity to make investments to improve their long-term financial security.”

Congress created the EITC and CTC to reward work; allowing these provisions to expire will only make it more difficult for hard-working Americans to make ends meet.