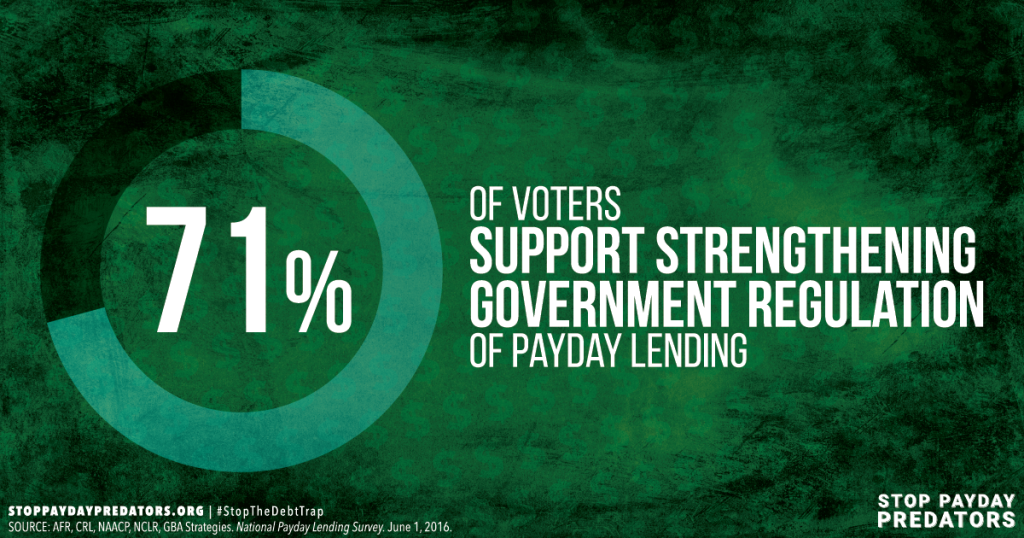

More than seven out of ten Americans want stronger regulation to rein in the predatory practices of payday lenders according to a survey released on June 15.

Payday lenders make small, short-term, unsecured loans at exorbitant interest rates (some as high as 400 percent or more) that usually come due within a few weeks after receipt of the loan. Unlike traditional bank and mortgage lenders, current federal lending rules do not require payday lenders to verify that borrowers can pay back their loans on time, without re-borrowing, before making a loan. These payday lenders also often require borrowers to provide direct access to their bank accounts, enabling the lender to withdraw payments regardless of whether the account contains sufficient funds resulting in costly overdraft fees.

On June 2, 2016, the Consumer Finance Protection Bureau (CFPB) proposed new rules designed to ban abusive lending practices that saddle consumers in Maine and nationwide with crushing debt. MECEP praised CFPB’s effort and said the “proposed rule begins to address predatory lending practices and level the playing field for lenders across the board. It will help to protect hardworking Maine consumers from onerous debt and let them use their paychecks for essentials like food and shelter and to invest in their and their children’s future.”

GBA Strategies conducted the survey on behalf of the Center for Responsible Lending, Americans for Financial Reform, the National Council of La Raza, and the NAACP. The firm interviewed 800 voters nationwide from May 26 to June 1. The results carry a margin of error of ±3.5 percentage points at the 95 percent confidence interval.

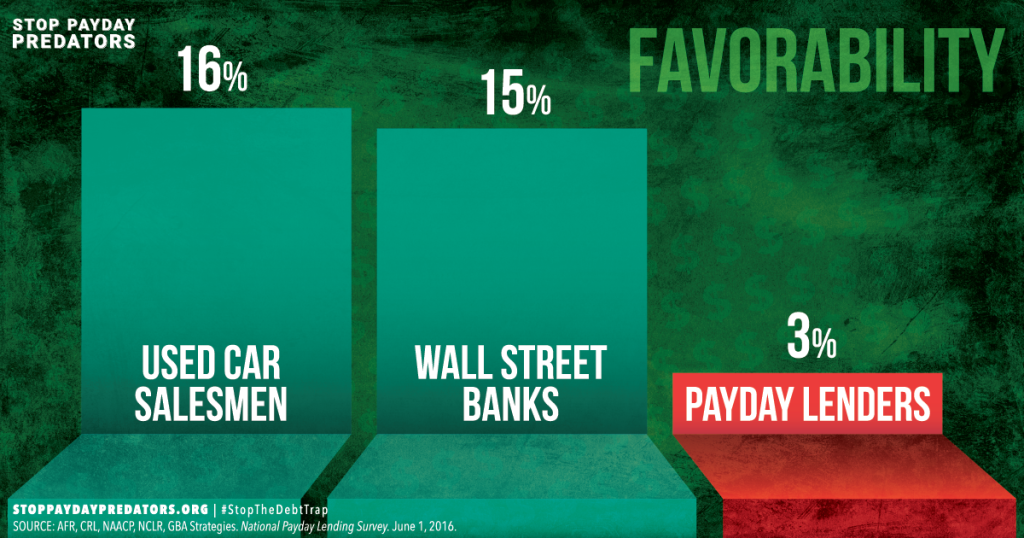

The poll also found that even used car sales reps (16 percent) and Wall Street Banks (15 percent) have higher public favorability ratings than payday lenders (3 percent).

MECEP has a web portal where you can submit comments to CFPB on its proposed rule to rein in abusive payday lending practices permanently. Please let CFPB know that you support a rule that will eliminate the predatory lending debt trap once and for all. Your comments will go directly CFPB:

http://stoppaydaypredators.org/MECEP/.

The public comment period closes on September 14, 2016.