It’s Shark Week. No, not the Discovery Channel’s homage to the denizens of the deep, but rather the annual media storm from consumer advocates who oppose the predatory lending practices of so-called payday lenders. Now, new research shows that women take out 60 percent of payday loans in order to make up for being laid off or having their hours cut, or to deal with health care expenses or the need to pay the costs of care for family members.

Women continue to earn less than their male counterparts, and they also continue to be the ones who assume responsibility for taking care of children and elder parents. Another troubling consequence of all this is that women earn less over their lifetimes so they accrue less in Social Security and retirement savings for later in life when they need it.

Payday loans are small, short-term, unsecured loans with exorbitant interest rates (in Maine, on average, 217 percent) that usually come due within a few weeks after receipt of the loan. Unlike traditional bank and mortgage lenders, current federal lending rules do not require payday lenders to verify before making a loan that the prospective borrowers can repay their loans on time. These payday lenders also often require direct access to the borrower’s bank accounts, enabling the lender to withdraw payments regardless of whether the account contains sufficient funds often resulting in costly overdraft fees. High rates and fees force borrowers into a virtually inescapable debt trap where they take out further loans (on average as many as 10 per year) to pay back the original loan.

The number of payday lenders has skyrocketed over the past two decades. The industry went from some 2,000 storefronts in 1996 to over 20,000 now, adding up to a $46 billion industry by 2015. They also operate on-line. In Maine where state law caps interest rates and requires lenders to be bonded and licensed, it is the on-line vendors operating illegally under the radar that often prey on women.

According to this latest study, Pinklining—How Wall Street’s Predatory Products Pillage Women’s Wealth, Opportunities, and Futures, borrowers no longer use payday loans primarily for emergencies. Rather they use them to pay for food, gas, utilities, health insurance, childcare costs, and helping relatives; household expenses that are most likely paid by women. These are the same women whose discriminatory wages, earnings, and savings make them vulnerable to loan predators.

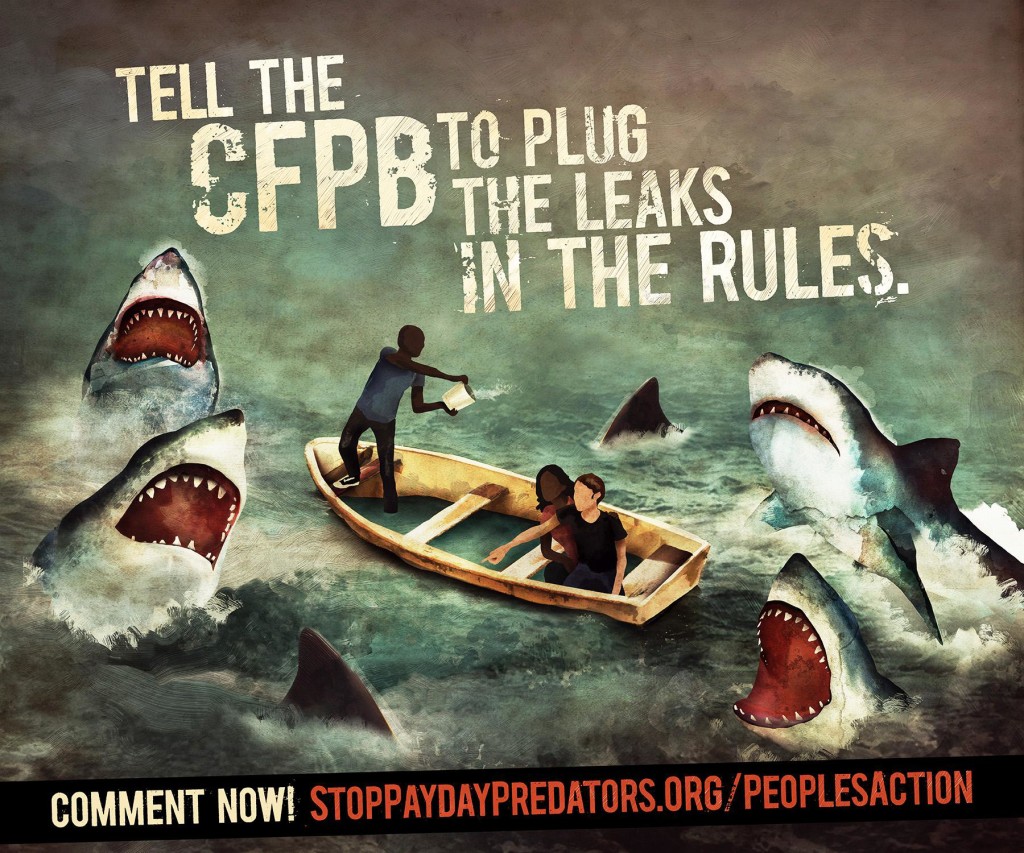

The Consumer Finance Protection Bureau (CFPB) has proposed new federal rules to crackdown on predatory lenders. They need to hear from the public that we need strong rules to rein in abusive payday lending practices. You can submit comments through MECEP’s web portal that will take you directly to CFPB. The public comment period closes on September 14, 2016.

Submit your comments here: http://stoppaydaypredators.org/MECEP/.