US Senate Republicans are still pushing to pass their latest version of a repeal of the Affordable Care Act, despite analysis from the Congressional Budget Office and others that shows that the Better Care Reconciliation Act (BCRA) would cause tens of millions of Americans to lose access to health care. MECEP’s own report details the effect on Mainers, including the loss of health insurance for more than 100,000 Mainers, and a significant decline in the economy, as measured by Gross State Product. A deeper dive into the numbers reveals that these effects would be felt across the state, but would be especially devastating for rural Maine, where insurance is more expensive, access to care is already limited, and where hospitals are the largest employers in many communities.

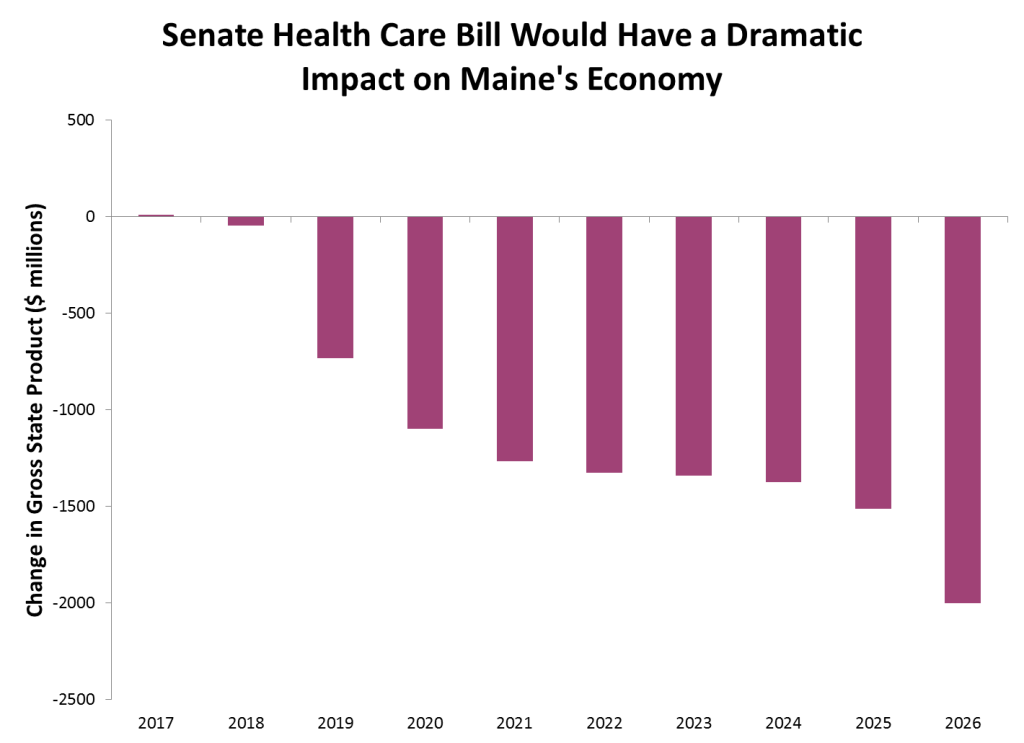

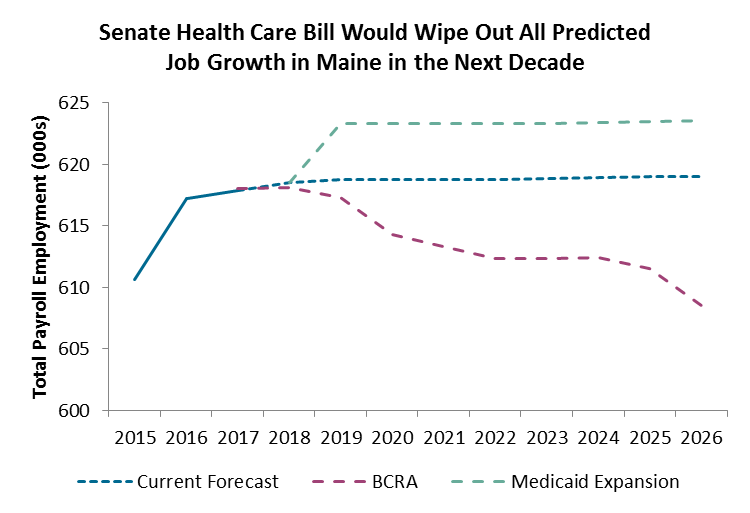

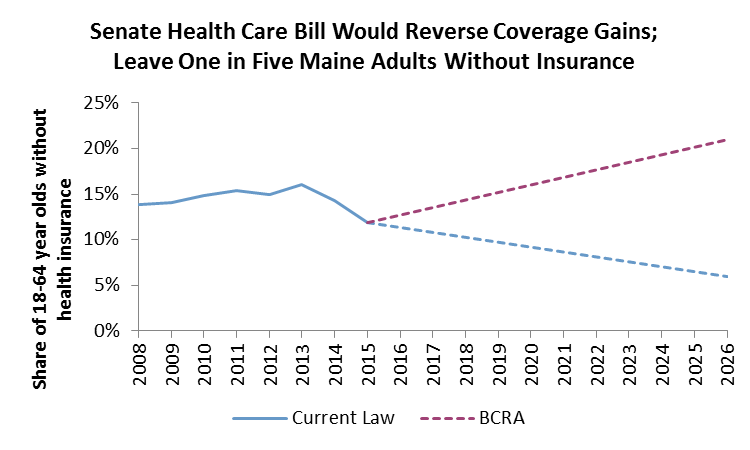

MECEP’s analysis of the BCRA shows that by 2026, Maine would receive $1 billion less every year in federal funding for Medicaid and subsidies to buy insurance on Healthcare.gov. The decline in economic activity associated with the loss of these federal funds would dwarf any growth stimulated by the BCRA’s tax cuts (primarily to the wealthiest Mainers), and result in $2 billion less economic activity every year. The BCRA would lead to the loss of 15,000 jobs, including 10,000 in the health care sector alone. An additional 120,000 Maine adults would not have health insurance, doubling the share of adults without health insurance to 21 percent – a rate that is unprecedented in modern times.

Sources: MECEP analysis of Congressional Budget Office Score of the BCRA, using IMPLAN economic modelling. Net change in GSP assumes Maine implements Medicaid expansion in 2019.

Sources: Current forecast numbers from the Maine Consensus Economic Forecast Committee, May 2017 forecast. Others from MECP analysis of Congressional Budget Office Score of the BCRA using IMPLAN economic modelling. 2016 job numbers are preliminary estimates.

Sources: Historic numbers from US Census Bureau, Small Area Health Insurance Estimates. Others from MECP analysis of Congressional Budget Office Score of the BCRA using IMPLAN economic modelling, with Healthcare.gov data and US Census Bureau data on health insurance coverage by type.

County Level Forecasts

| Under the BCRA, by 2026… | ||||||||||

|

Millions $ |

Total jobs |

Healthcare jobs |

Additional Uninsured Adults |

Uninsured Non-elderly adults |

||||||

| Federal funds | Tax Breaks | Total Economic Impact | ||||||||

| Androscoggin | -77 | 4 | -137 | -1035 | -611 | 9,000 | 18% | |||

| Aroostook | -81 | 2 | -124 | -972 | -679 | 7,000 | 25% | |||

| Cumberland | -172 | 51 | -308 | -2166 | -1367 | 28,000 | 20% | |||

| Franklin | -28 | 1 | -37 | -333 | -232 | 3,000 | 24% | |||

| Hancock | -73 | 5 | -108 | -905 | -625 | 3,000 | 16% | |||

| Kennebec | -82 | 4 | -134 | -1022 | -659 | 18,000 | 28% | |||

| Knox | -40 | 6 | -56 | -463 | -316 | 2,000 | 16% | |||

| Lincoln | -31 | 4 | -45 | -406 | -289 | 2,000 | 16% | |||

| Oxford | -56 | 2 | -72 | -608 | -454 | 6,000 | 24% | |||

| Penobscot | -121 | 9 | -203 | -1539 | -978 | 16,000 | 22% | |||

| Piscataquis | -16 | < 1 | -20 | -183 | -141 | 2,000 | 24% | |||

| Sagadahoc | -22 | 3 | -27 | -202 | -146 | 4,000 | 16% | |||

| Somerset | -59 | 1 | -66 | -523 | -383 | 5,000 | 24% | |||

| Waldo | -39 | 2 | -53 | -440 | -301 | 2,000 | 16% | |||

| Washington | -45 | 1 | -59 | -487 | -351 | 3,000 | 25% | |||

| York | -123 | 14 | -187 | -1481 | -998 | 13,000 | 21% | |||

| Statewide | -1,056 | 67 | -1,999 | -15,000 | -10,020 | 123,000 | 21% | |||

Sources: MECEP analysis of Better Care Reconciliation Act using IMPLAN economic modelling of the Congressional Budget Office score, population projections from the Office of the Maine State Economist, US Census Bureau, American Community Survey data, Healthcare.gov marketplace data; Internal Revenue Service Statistics of Income data.

Notes: Statewide totals do not match combined county totals due to rounding, and inter-county impacts that are not captured by the county-by-county analyses.

Methodology

Total economic impacts of the BCRA were calculated from three components:

- The withdrawal of federal funding for advance premium tax credits (APTCs) and cost-sharing reductions (CSRs) to subsidize insurance for low-income Mainers. The total annual value of these subsidies was calculated using Healthcare.gov data for 2017. The average value of APTCs and CSRs was adjusted for projected health expenditure inflation, as calculated by the Centers for Medicaid Services. The annual number of Mainers enrolled in plans through Healthcare.gov was increased to account for a 90% take-up rate among eligible Mainers without insurance by 2026.

- The loss of federal funding for Medicaid costs (including the loss of Medicaid expansion and the BCRA’s cap on per-person reimbursements). Medicaid enrollment for Maine was projected through 2026, assuming that eligibility would be expanded to 138% of the federal poverty level in 2019, enrolling an additional 70,000 low-income Mainers. Cuts under the BCRA include not covering these 70,000 individuals, plus declines in enrollment forced by the imposition of the per-capita cap. By 2026, the cap would require that adult non-elderly, non-disabled Medicaid enrollment in Maine be reduced by 30%.

- The stimulus caused by the rollback of affordable care act taxes. The majority of these tax cuts would go to the wealthiest Maine households, through the elimination of the high-income Medicare surcharge, and the net investment tax. From 2023, the tax penalty for not having health insurance would be eliminated for all Mainers. The value of these tax breaks was calculated using the Internal Revenue Service’s Statistics of Income data for 2014, adjusted for inflation at a projected annual rate of 2%.