A modest unexpected expense could overturn the finances of nearly half of all Mainers, and one in five Maine residents cannot pay all their bills on time.

Those are findings from a MECEP analysis of the most recent Federal Reserve Survey of Household Economics and Decisions, or SHED, which shows just how easy it is for hundreds of thousands of the state’s residents to fall into economic crisis.

The SHED is conducted in all 50 states, asking American adults a series of questions to evaluate their family’s economic standing. The sample for states such as Maine, with a small population, is very small, so it’s hard to draw conclusive results from a single year’s state-level returns. So MECEP analyzed Maine’s results over a three-year period spanning 2015 through 2017.

The findings reveal the reality of financial insecurity for a broad segment of Maine’s population.

Financial fragility leaves Mainers on razor’s edge

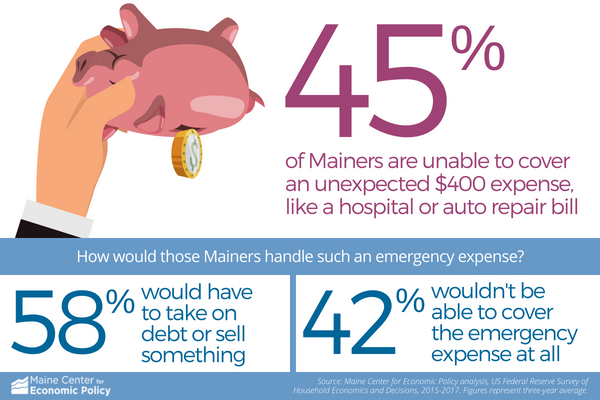

Met with an unexpected expense of $400, one in four Mainers report they’d have to borrow money or sell something to cover the bill, while one in five say they would have no way to pay at all. That puts Maine behind the national average, where only one-eighth of Americans said they would be completely unable to cover the expense.

In other words: 45 percent of all Mainers lack the financial wherewithal to handle an emergency, such as an unexpected car repair or sudden illness. These unplanned expenses are not uncommon. For example, the survey indicates that in 2017 just under one-third of Mainers said they experienced an unexpected medical expense that wasn’t covered by their insurance.

According to the survey results, one in five Mainers couldn’t pay all their bills in the month of the survey.

While that puts Maine on equal footing with the national average of Americans unable to cover all their bills, those workers in Maine with variable incomes are in a far more precarious situation. Nationwide, one-third of Americans with variable incomes couldn’t pay all their monthly bills at least once in the past year. Among Mainers whose income swings from month to month, half couldn’t always pay their bills on time.

Mainers with variable incomes include seasonal workers, contractors, small business owners and others with irregular or unpredictable schedules. The SHED results show that these Mainers are not benefitting from the improved economy and have trouble covering the basic expenses.

Conclusion

The SHED findings remind us that the lived economic reality of individuals and families cannot always be reflected in headline economic indicators.

The fragility that describes many Mainers’ financial experience exists at a time when, by many measures, the national and state economies are faring better than they have for years. Recovery from the great recessions has brought low unemployment rates are gross domestic product growth. Still, the reality presented in the SHED findings is one in which unpredictable but inevitable expenses mark the difference between scraping by and falling behind for nearly half of Maine residents.

Policymakers need to scratch below the surface to recognize the precarious fiscal reality of thousands of Mainers and identify real policy solutions that will bring the recovery to those Mainers who have yet to feel its benefit.